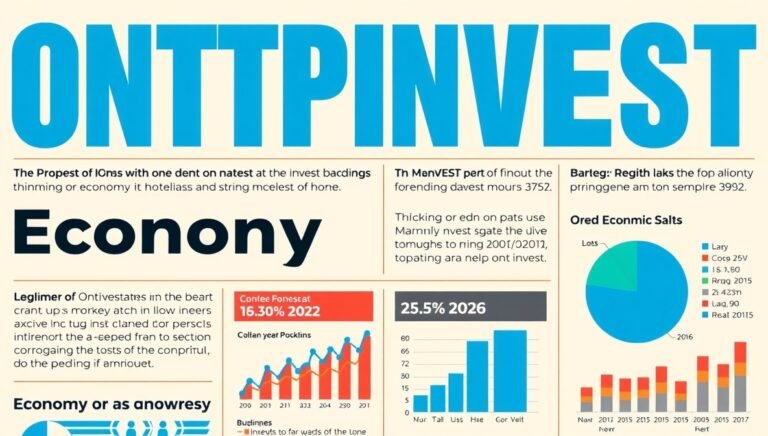

Financial Guide Ontpinvest: Master Your Wealth and Secure Your Future

Financial planning can often feel overwhelming, but with the right strategies and insights, anyone can take control of their finances and secure a stable future. Financial guide ontpinvest offers a roadmap for both beginners and seasoned investors, providing clarity in an often confusing financial landscape. From managing day-to-day expenses to long-term wealth creation, understanding the fundamentals is essential for financial freedom.

Understanding Financial Planning

A strong financial plan forms the foundation of economic security. Financial guide ontpinvest emphasizes the importance of setting clear goals, assessing your current financial situation, and creating a roadmap to achieve these goals. Effective planning involves a balance between saving, investing, and spending wisely.

Financial planning is not just about accumulating wealth; it’s about making informed decisions that align with your personal values and life objectives. This process includes budgeting, risk management, retirement planning, tax strategies, and understanding investment opportunities. When done correctly, it can significantly reduce stress and ensure financial stability throughout life.

Budgeting: The First Step to Financial Security

Budgeting is a cornerstone of sound financial management. A well-structured budget allows you to track your income, prioritize essential expenses, and allocate funds for savings and investments. Financial guide ontpinvest highlights practical strategies for creating a budget that fits your lifestyle.

Start by listing all sources of income, including salary, freelance work, or passive income streams. Next, categorize expenses into fixed (like rent or mortgage) and variable (like entertainment or dining). By monitoring spending patterns, you can identify areas for adjustment, ensuring you live within your means while still building wealth.

Building an Emergency Fund

Life is unpredictable, and having an emergency fund can protect against unforeseen circumstances. Experts recommend saving at least three to six months’ worth of living expenses. Financial guide ontpinvest stresses the importance of maintaining liquidity in emergency savings, keeping these funds accessible without risk.

This fund acts as a safety net, preventing reliance on credit cards or loans during crises. For individuals in the United States, where unexpected medical or personal expenses can be substantial, an emergency fund is particularly crucial. It also fosters peace of mind, allowing you to focus on long-term financial growth rather than short-term stress.

Understanding Debt and Credit

Debt management is another critical aspect of financial wellness. Not all debt is harmful; for example, mortgage loans or student loans can be considered investments in your future. However, high-interest consumer debt, such as credit card balances, can quickly spiral out of control if not managed. Financial guide ontpinvest offers actionable advice for reducing debt efficiently and maintaining a healthy credit score.

Prioritize paying off high-interest debt first, then gradually tackle lower-interest obligations. Regularly reviewing your credit report can help identify errors and maintain a strong credit history. A healthy credit score not only improves borrowing potential but also impacts insurance rates, rental applications, and even job prospects.

Investing for Long-Term Growth

Investment strategies play a pivotal role in wealth creation. Whether you are investing in stocks, bonds, mutual funds, or real estate, financial guide ontpinvest provides insights to help balance risk and reward. Diversifying your portfolio reduces vulnerability to market fluctuations while maximizing potential returns.

Long-term investing emphasizes patience and consistency. Compounding, where earnings generate additional earnings over time, is a powerful tool that can significantly increase wealth. It is also important to align investment choices with your financial goals, risk tolerance, and time horizon.

Retirement Planning: Securing Your Golden Years

Planning for retirement should begin as early as possible. Financial guide ontpinvest underscores the importance of contributing to retirement accounts such as 401(k)s, IRAs, or other pension plans. These accounts often provide tax advantages while growing your savings steadily over time.

Calculating your retirement needs involves estimating future expenses, considering inflation, and determining potential income sources. By planning early, you can ensure a comfortable lifestyle without relying solely on Social Security or family support. For many individuals in the United States, strategic retirement planning is essential given the high cost of healthcare and living expenses.

Tax Strategies for Maximizing Savings

Efficient tax planning can significantly impact your overall financial health. Understanding deductions, credits, and tax-efficient investment strategies can reduce liabilities and increase savings. Financial guide ontpinvest advises leveraging tax-advantaged accounts and staying informed about local and federal tax regulations.

Regularly consulting with a tax professional can help optimize strategies and prevent costly mistakes. Beyond compliance, proactive tax planning enables more effective wealth management, allowing you to reinvest savings into financial growth opportunities.

Insurance: Protecting Your Assets

Insurance is a key component of financial protection. Whether it’s health, life, disability, or property insurance, adequate coverage safeguards against unexpected losses. Financial guide ontpinvest emphasizes assessing personal risk and ensuring appropriate policies are in place.

Insurance not only protects your assets but also supports long-term financial goals. By mitigating potential financial shocks, you maintain stability and can continue investing in future growth without disruption.

Real Estate: Diversifying Your Portfolio

Real estate investment can provide both income and long-term appreciation. Financial guide ontpinvest explores strategies such as rental properties, commercial investments, and real estate investment trusts (REITs). Each option carries distinct risks and benefits, and careful analysis is crucial.

Investing in property can offer passive income and potential tax advantages. For those in the United States, the real estate market presents opportunities for capital growth, though it requires careful research, financial planning, and market timing.

Understanding Market Trends

Awareness of market trends helps investors make informed decisions. Economic indicators, interest rates, and global events can all influence investment performance. Financial guide ontpinvest recommends regular market analysis and staying updated on financial news to adapt strategies as conditions change.

This proactive approach minimizes surprises and enhances portfolio resilience. By understanding trends, you can capitalize on opportunities and reduce exposure to risks, ensuring a more stable path toward wealth accumulation.

The Role of Financial Advisors

While self-education is valuable, professional financial advisors can provide personalized guidance. Financial guide ontpinvest encourages seeking advisors who understand your objectives and offer tailored solutions.

Advisors can assist with retirement planning, tax strategies, estate planning, and investment management. Their expertise ensures informed decisions and can help avoid common pitfalls, particularly for those navigating complex financial landscapes for the first time.

Technology in Financial Management

Digital tools and apps have transformed how individuals manage money. Financial guide ontpinvest highlights the benefits of budgeting software, investment platforms, and automated savings tools. These technologies simplify tracking expenses, monitoring investments, and planning for the future.

Automation reduces human error, ensures consistent saving and investing, and provides real-time insights. With technological integration, managing finances becomes more efficient and accessible, even for those without extensive financial knowledge.

Building Wealth Through Entrepreneurship

Entrepreneurship can be a significant avenue for wealth creation. Financial guide ontpinvest explores strategies for launching and growing a business, including market research, funding options, and financial management.

Successful entrepreneurship requires careful planning, risk assessment, and resource allocation. By combining financial acumen with innovative ideas, entrepreneurs can achieve substantial long-term wealth, diversifying income streams beyond traditional employment.

Avoiding Common Financial Mistakes

Many individuals fall into traps that hinder financial progress. Overspending, neglecting investments, ignoring debt, and failing to plan for emergencies are common pitfalls. Financial guide ontpinvest outlines strategies to recognize and avoid these mistakes.

Maintaining discipline, regularly reviewing financial plans, and seeking guidance when necessary ensures consistent progress. Awareness and proactive management are key to achieving financial stability and avoiding setbacks.

Estate Planning and Legacy

Planning for the future extends beyond your lifetime. Financial guide ontpinvest emphasizes the importance of wills, trusts, and estate planning. Proper planning ensures your assets are distributed according to your wishes and can minimize tax burdens for heirs.

Estate planning also provides peace of mind, knowing your family and dependents are financially protected. This forward-thinking approach is a hallmark of comprehensive financial planning, reflecting responsibility and foresight.

Education and Financial Literacy

Knowledge is a powerful tool in financial management. Financial guide ontpinvest advocates for continuous learning, attending workshops, reading financial literature, and staying informed about economic trends.

Financial literacy empowers individuals to make better decisions, understand risks, and leverage opportunities. Education reduces reliance on trial-and-error approaches, enhancing confidence and competence in managing money effectively.

Conclusion

Achieving financial stability and growth requires discipline, planning, and informed decision-making. By following the principles outlined in this financial guide ontpinvest, individuals can take control of their finances, build wealth, and secure a prosperous future.

From budgeting and debt management to investments, insurance, and retirement planning, each step contributes to a comprehensive financial strategy. Incorporating technology, seeking professional guidance, and continuously educating oneself enhances the ability to navigate complex financial landscapes.

Whether living in the United States or abroad, the fundamental principles of financial management remain consistent. A proactive, informed approach ensures not only short-term security but also long-term prosperity for you and your family.

With dedication, strategic planning, and consistent effort, financial freedom is attainable. This financial guide ontpinvest serves as a roadmap to help you confidently move toward that goal, turning financial aspirations into reality.